Star Entertainment Group, one of the largest casino operators in Australia and owners of notable casinos The Star Sydney, The Star Brisbane and Queen’s Wharf Brisbane (and others), has continued its downward spiral in March.

Financial Performance and the Casino Industry

Star reported disappointing Financial Year (FY) 2025 Q2 revenues of 299m (AUD) compared to Q1’s 351m, resulting in an $8m loss. (Colitco)

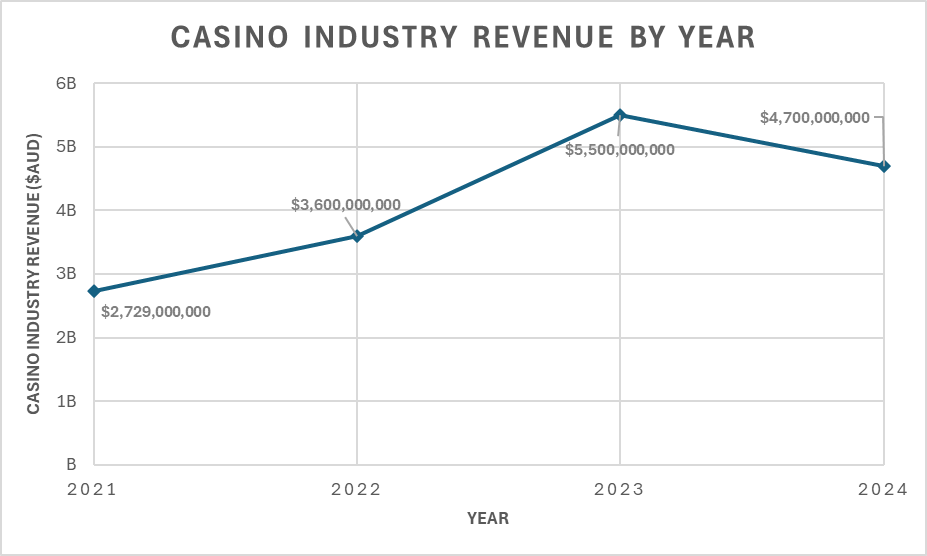

The casino industry has declined between 2023’s revenues of ~$5.4b (Gambling Industry News), and 2024’s revenue of $4.7b (IBISWorld). Star seems to represent a clear depiction of the government’s crackdown on mismanagement and negligence that continues to encircle the Gambling industry annually.

Data Sources: VRGF; iGB; IBISWorld

The company is currently working on refinancing its operations via a $250m bridge loan facility with King Street Capital Management (although not available until April 2025), alongside a potential 5-year recapitalisation strategy with another lender. (Fool.com).

Interest from other third parties, such as Bally’s Corporation’s $250m acquisition bid for a majority stake in Star, highlight Star’s ability to continue operating despite its falling revenues.

Ongoing Issues

Investigations into Star’s involvement in money laundering activities in 2021 have since led the NSW Independent Casino Commission (NICC) to suspend Star’s casino licence in September 2022, which has since deferred suspension until the end of March 2025. (Addisons).

Star’s shares have been suspended from trading on the Australian Stock Exchange on 3 March 2025 due to their failure to lodge their half-year FY25 report. (Fool.com).

My Thoughts

It’s likely a company the size of Star, with large-scale operations in Queensland and NSW, won’t result administration action in the short-term. Depending on its ability to draw down its funding and execute an asset consolidation and recapitalisation strategy, Star may bounce back in coming years with increased liquidity. This will be depend on the Australian casino industry’s ability to resume operations business as usual post-covid.

Regulatory changes may continue to crack down on financial mismanagement and conduct, which may result in leadership changes and some restructuring. In any potential insolvency incident, Star’s 9,000 employees will be at the forefront of the impact.

You must be logged in to post a comment.